how to claim eic on taxes

Complete the return wages dependents etc as you normally would. Once within the Summary page please click Payments.

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Taxpayer neglected to mark a box for dependent full time student under age 24 to qualify.

. The childless maximum credit range starts when income for tax year 2021 is 9800 up from 7000 The phaseout for childless EIC for tax year 2021 begins at 11600 up from 8880 or. To qualify for the EITC you must. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Were auditing your tax return and need information from you to verify the EITC ACTC or AOTC you claimed. You can find the amount of Earned Income Credit received within the Summary page. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers.

When can you claim the Earned income tax Credit. For the 2021 tax year the earned income credit ranges from. Your self-employment income minus expenses counts as earned income for the Earned Income Credit EIC.

If you were eligible you can still claim the EITC for prior years. Earned Income Credit EIC Start or update. For 2021 you have to have earned less than 21430 to qualify if you have no children.

You qualify for the EITC as long as you were at least 25 but younger than 65 on December 31 of the tax year you earned. The Internal Revenue Service IRS is providing temporary relief for the Earned Income Tax Credit EITC for tax year 2020. FreeTaxUSA has what you need.

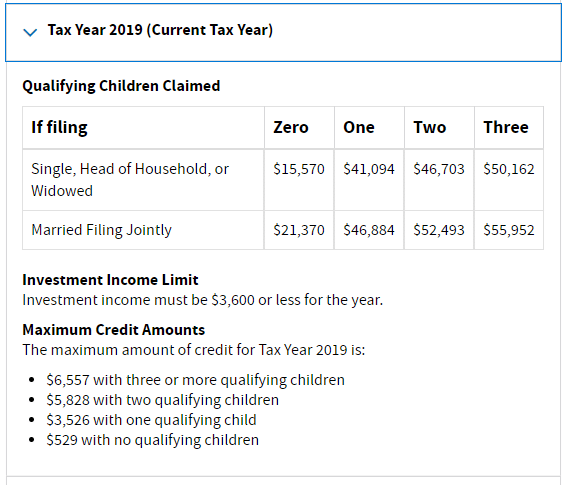

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For 2018 the maximum Earned Income Tax Credit per taxpayer is. Your maximum credit will be.

Three or more qualifying children. Some of these changes are temporary for the 2021 tax year only others are. Schedule EIC which is used to claim.

The EITC is a refundable federal tax credit for low to moderate income working individuals and families. Have investment income below 10000 in the tax year 2021. 5828 with two Qualifying Children.

You must have a valid Social Security number for you and each of your qualifying children by the due date of the return including extensions. If you do not have qualifying children you must have a low income to claim this tax credit. One qualifying child.

Income guidelines for the current tax year are listed in Publication 596. If you qualify you can use the credit to reduce the taxes you owe. 529 with no Qualifying Children.

You will see Earned Income Credit and. If you qualify the credit can increase your federal tax refund by up to. We may be holding your refund for the following credits.

Have worked and earned income under 57414. We dont make judgments or prescribe specific policies. You have three years to file and claim a refund from the due date of your tax return.

The amount you can get back from it depends on factors like the. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. 3526 with one Qualifying Child.

Scroll down to You and Your Family and click on Show More. All Extras are Included. Ad Premium Federal Tax Software.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. IRS E-File Fast Refunds Always Free. 21430 27380 if married and filing a joint.

Complete Edit or Print Tax Forms Instantly. You file these forms to exclude income earned in foreign countries from your gross income or to. See what makes us different.

The American Rescue Plan Act of 2021 made several changes to the Earned Income Tax Credit. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Basic Qualifying Rules.

Ad Access IRS Tax Forms. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Go to Screen 382 Recovery Rebate EIC Residential Energy Other Credits.

You must claim all deductions allowed and resulting from your business. Follow the interview questions until you see the screen that asks Do any. You cant claim the earned income credit if you file Form 2555 Foreign Earned Income.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. How do you amend your return to claim the earned income tax credit. The EITC is worth between 560 to 6935 in 2022 up from the 2021 EITC of between 543 and 6728.

Claim the EITC for Prior Years. Income limitations also apply. Your earned income and adjusted gross income must be less than.

If your federal earned income was higher in 2019 than in 2020 you. Scroll down to the Earned Income. Claim the credit right on Form 1040 and add Schedule EIC if you.

Form 1040 Earned Income Credit Child Tax Credit Youtube

What Is The Earned Income Credit Check City

.png)

What Is The Earned Income Credit Check City

Irs Earned Income Tax Credit In 2022 Fingerlakes1 Com

Here S What You Need To Know About The Earned Income Tax Credit In 2021

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Simplified Reminders To Increase Take Up Of Tax Credits The Abdul Latif Jameel Poverty Action Lab

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

All 7 Itr Forms Released For E Filing Income Tax Department The Central Board Of Direct Taxes Had Notified The New Income Tax Income Tax Return Filing Taxes

Understanding Taxes Earned Income Credit

Pin On Organizing Tax Information

Eic Frequently Asked Questions Eic

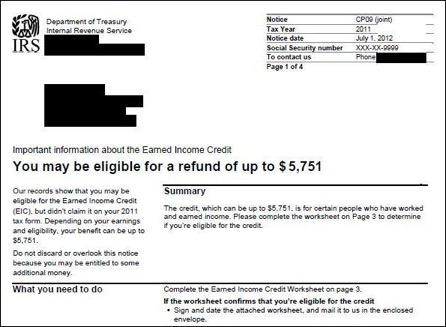

Summary Of Eitc Letters Notices H R Block

4 Tips For Notaries Claiming Home Office Tax Deductions Notary Notary Public Business Notary Jobs

Understanding Taxes Earned Income Credit

2021 Schedule Eic Form And Instructions Form 1040

Earned Income Tax Credit Tax Graph Income Tax Income Tax Credits